Why Renting In Turkey Feels Like a Different World

I’ve just returned from Turkey—not the “Turkey teeth and counterfeit handbags” holiday people imagine—but from exploring local towns, chatting with residents, and getting a glimpse into real Turkish life. And let me tell you, it’s worlds apart from the UK’s housing hustle. While we’re busy booking EICRs and chasing EPCs, Turkey seems to run on something much simpler: strong coffee, close families, and a whole different take on renting and living.

So, let’s dive into a side-by-side of Turkey vs. the UK when it comes to housing, rentals, and landlord responsibilities. 🏘️

First, Let’s Talk Tenants: How Many People Rent?

% of Renters Turkey Vs UK

UK

• Around 36% of UK households are renters, split almost evenly between private renters and social renters.

• In London, the figure jumps to nearly 50% for private renting.

• The private rental sector has doubled since 2001.

Turkey

• Only ~27% of Turkish households rent (as of recent estimates).

• The majority are homeowners, often mortgage-free thanks to family-built or inherited property.

• Interestingly, this percentage has increased slightly in urban and tourist-heavy areas like Istanbul, Antalya, and Izmir, as tourism and short-term lets rise.

Tourism: Blessing or Burden?

Turkey’s booming tourism industry (over 56 million visitors in 2023) has made a noticeable impact on the housing market.

• In tourist hubs like Bodrum and Antalya, short-term rentals (Airbnb, Vrbo) have become extremely popular.

• This has driven up prices and reduced long-term housing availability for locals.

• In contrast to the UK’s concern over “second home syndrome,” Turkey is facing a similar issue, especially near the coast.

Did you know? In some Turkish districts, more than 1 in 4 properties are now listed for short-term rent during peak season.

Family First: The Multigenerational Home

One of the most striking differences? Turkish households tend to be larger—not because they’re buying more square footage, but because everyone’s living under one roof.

• It’s common for three generations to share a home.

• Even in rental homes, space is optimized: grandparents get the balcony, kids get the mezzanine, and someone’s aunt is probably in the lounge.

Meanwhile, in the UK:

• The average household size is 2.4 people, and many young people are stretching to afford studio flats or house shares.

Fun fact: Turkish homes often have separate kitchens and double lounges, one for guests and one for daily life—a reflection of hospitality culture.

Regulations: UK vs Turkey

In the UK:

Landlords must ensure properties meet a suite of regulations:

• Gas Safety Certificate (GSC) – annual.

• Electrical Installation Condition Report (EICR) – every 5 years.

• Energy Performance Certificate (EPC) – every 10 years.

• Fire safety, deposit protection, carbon monoxide alarms, the list goes on…

In Turkey:

• Regulations are a little… lighter.

• No nationwide equivalent to GSCs, EICRs, or EPCs.

• In urban municipalities, landlords may need DASK insurance (compulsory earthquake insurance).

• Renting out short-term (under 100 days) now requires a Tourism License under new 2024 rules to protect local housing stock.

Most Turkish landlords rely on informal agreements, especially when renting to locals, though agencies are gaining popularity in cities.

Let’s Talk Prices: Pound vs Lira

Now here’s where things get spicy—property prices.

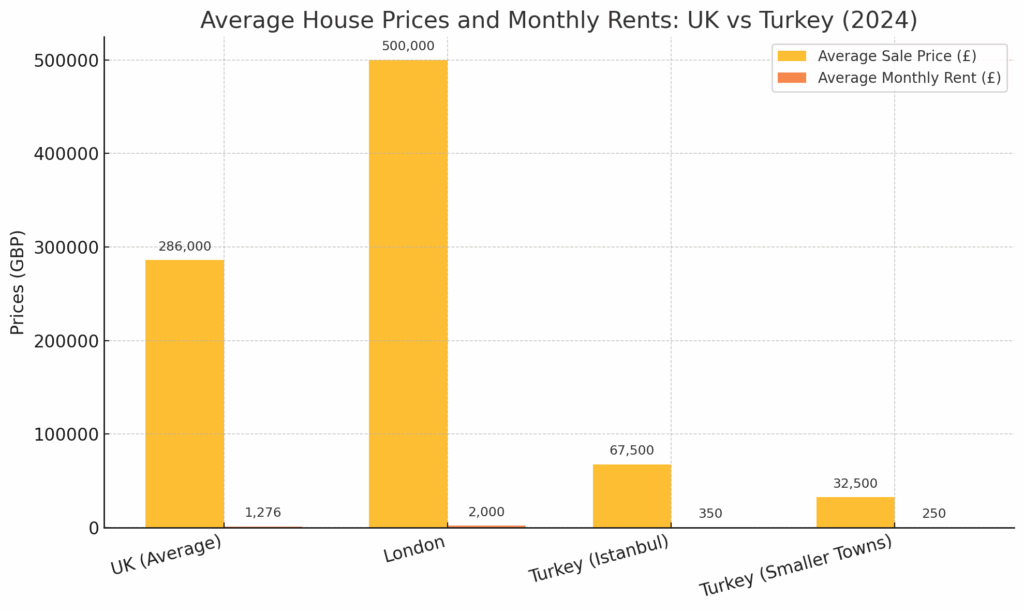

In the UK, the average house price in 2024 was around £286,000. In London, you’re looking at £500,000 or more. Renting isn’t much better, with the average rent in England hitting £1,276/month, and Greater London averaging over £2,000/month.

Turkey, by comparison, offers significantly more value—at least for now. As of 2024:

• The average property price in Istanbul is approximately 2.5 to 3 million Turkish Lira, which is around £60,000–£75,000 depending on location and exchange rate.

• In smaller towns or rural areas, you can still buy a home for as little as £25,000–£40,000.

Rental prices also vary widely:

• In tourist hot spots like Antalya or Bodrum, short-term holiday rentals have pushed up prices, often matching or

exceeding UK rental rates during high season.

• But in everyday neighbourhoods, a spacious family apartment might cost just £200–£400/month.

That said, rising inflation and demand from tourism have seen Turkish property prices increase significantly—often doubling over the past 5 years—making it harder for locals to get on the ladder in big cities.

Do They Use Letting Agents?

Short answer: Yes, but not like we do.

• In Turkey, estate agents (“Emlak”) are more common in sales than rentals.

• However, in cities and tourist areas, many landlords now use property management companies, especially for holiday lets.

• Unlike the UK, where letting agents are often the gatekeepers of compliance, responsibility lies heavily on the landlord themselves in Turkey.

Final Thoughts: A Tale of Two Markets

In the UK, compliance is king. You can’t swing a door handle without needing a safety check. In Turkey, the housing market feels more personal and informal—especially for locals. Families share homes, landlords often know tenants by name, and the pace of property life is… gentler.

But with tourism rising, regulations are slowly catching up, particularly in areas where short-term lets are swallowing up long-term housing.

If you’re a UK landlord or letting agency wondering how the other half lives, the answer might surprise you. It’s not all holiday villas and rooftop terraces—it’s grandmothers making tea, generations living together, and a housing culture built on community (with far fewer checklists!).

Thinking of Renting in Turkey?

Here’s a quick checklist:

• ✅ Get DASK insurance.

• ✅ For short-term lets, register for a Tourism License.

• ✅ Use a local “Emlak” agent for help.

• ✅ Don’t expect tenants to ask for a Gas Safety Cert—they might just offer you a glass of çay instead.

Want help navigating our side of landlord life? Whether it’s your 5-year EICR or your next EPC, we’re here to keep you compliant, safe, and stress-free.